Q3 Spending Trends

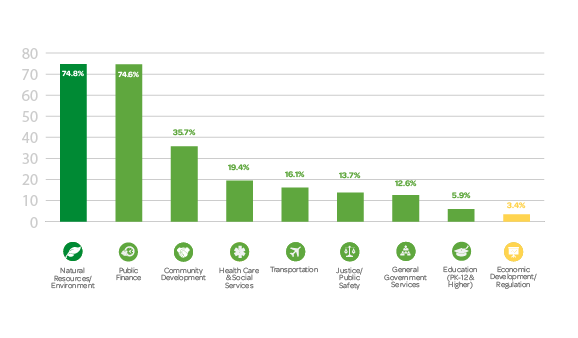

Q3 is usually a strong performer in the SLED market as many entities are beginning their fiscal year purchasing activity. Accordingly, GovWin IQ’s State and Local Bid Notifications database saw a 12.7% increase in solicitations posted in Q3 2017 vs. Q3 2016. This is about 1 point higher than Q2 growth and demonstrates continued strength in the market.