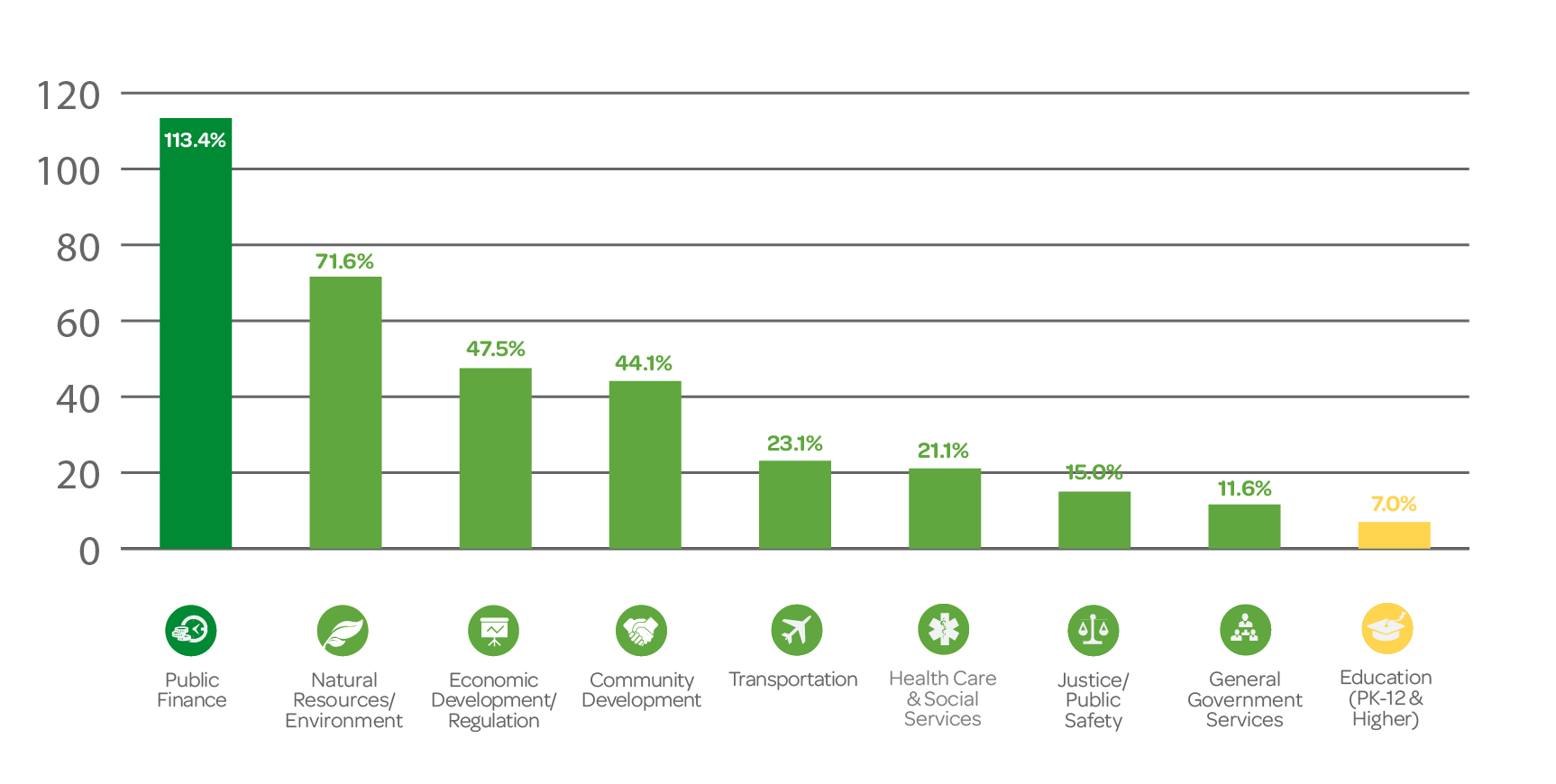

Q2 Spending Trends

The great news for the overall SLED market is that every vertical grew for the quarter. One note, since GovWin expanded vertical coverage in Q4 2016 to include public utilities, there was no comparable coverage for Q2 2016. As a result, while growing, it does not appear on this chart.